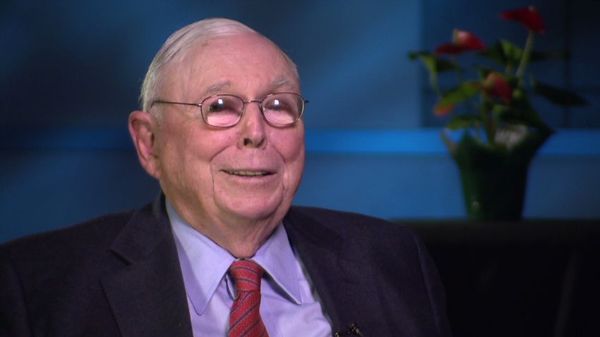

Charlie Munger, the billionaire investor and longtime friend of Warren Buffett, passed away at the age of 99. He played a crucial role as vice chairman of Berkshire Hathaway, the renowned investment firm. Munger’s peaceful demise occurred on Tuesday morning at a California hospital, as confirmed by a press release from the company. Although no cause of death was specified, Munger’s impressive legacy will forever be remembered.

Born as Charles Thomas Munger on January 1, 1924, in Omaha, Nebraska, he ventured on a remarkable journey that encompassed both patriotism and academic excellence. Munger served in the US Army during World War II after leaving the University of Michigan at the young age of 19. Upon returning from the war, he attended Harvard Law School, where he graduated with honors in 1948. Shortly after, Munger relocated to Southern California and pursued a successful career as a real estate lawyer.

The news of Munger’s passing reverberated throughout Wall Street, where his contributions to Berkshire Hathaway had been nothing short of extraordinary. CEO Warren Buffett expressed his deep appreciation in the press release, acknowledging that Berkshire Hathaway’s success was indebted to Munger’s wisdom and inspiration. Moreover, Mohamed El-Erian, Allianz chief economic adviser, highlighted the collaborative approach and common sense displayed by Munger and Buffett, asserting that their investment powerhouse significantly improved countless lives.

Munger’s influence extended even beyond the financial realm. Many individuals initially sought out his knowledge to gain insights into wealth generation, but they discovered much more along the way. As Whitney Tilson, an investor and expert on Buffett and Munger, explained, “His impact went far beyond the investing world. People discovered him, thinking that they would learn about ways to make money, but they got so much more.” Munger’s famous quote, “If all you have is a hammer, the world looks like a nail,” epitomizes his ability to provide profound wisdom.

Despite his age, Munger remained actively engaged in analyzing global markets until his final days. Just a few weeks ago, he described Warren Buffett’s decision to invest billions of dollars in Japan as a “no-brainer.” Munger compared this endeavor to having an open chest from which God poured money—a classic example of his characteristic wit.

Warren Buffett’s Trusted Right-Hand Man

Munger and Buffett first crossed paths in 1959 when they met at a dinner in Omaha. Munger had traveled there for his father’s funeral, and the encounter sparked an instant friendship. Reflecting on their first meeting, Buffett stated, “I’m not going to find another guy like this… We just hit it off.”

In 1978, Munger officially joined Berkshire Hathaway as vice chairman. Throughout his career, he was known as Buffett’s sharp-witted sidekick, renowned for his candid opinions regarding the stock market and the economy. Devoted Berkshire fans eagerly anticipated Munger’s pithy one-liners, such as his memorable quote during a 2015 annual shareholders meeting: “If people weren’t so often wrong, we wouldn’t be so rich.”

Towards the end of his life, Munger attracted attention due to his controversial remarks. Despite criticism from Western governments regarding human rights violations, he consistently praised China’s communist government. Notably, Munger commended the country even during its crackdown on Chinese tech giant Alibaba, a prominent investment at Daily Journal, a newspaper publisher and investment firm that Munger led from 1977 until 2022.

Berkshire Hathaway has yet to comment on Munger’s passing, but his legacy as one of the most trusted partners of Warren Buffett will always be cherished.

— CNN’s Nicole Goodkind contributed to this report.